Originally posted on May 15, 2019 @ 10:13 AM

As a full-time driver, the expenses we incur to “Drive for Dollars” daily include gas, oil changes, car washes, tires, and other routine maintenance as outlined in the car owner manuals (which I’m sure most drivers do not read or adhere to).

Uber does not cover or reimburse for ANY of these expenses.

If you drive your own car, you are out-of-pocket. I cannot tell you all the service I had done on my 2010 Hyundai before the timing belt broke, causing engine damage. It gave up the ghost June 25, 2018.

If you rent, thankfully, you only have to pay for the gas and car washes. However, there is the weekly rental car expense held for a few days by the bank and then released. The rental is actually payable in person every 28 days in a lump sum. I am on my second car since August 2018.

There is a larger expense, however, that most drivers are not aware of until tax time.

Uber Deducts From Total Earnings

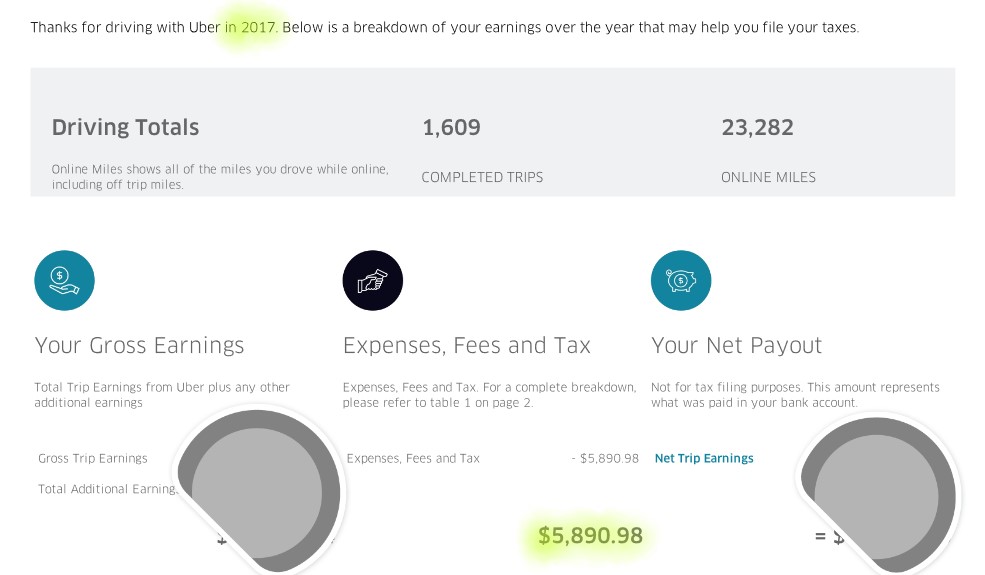

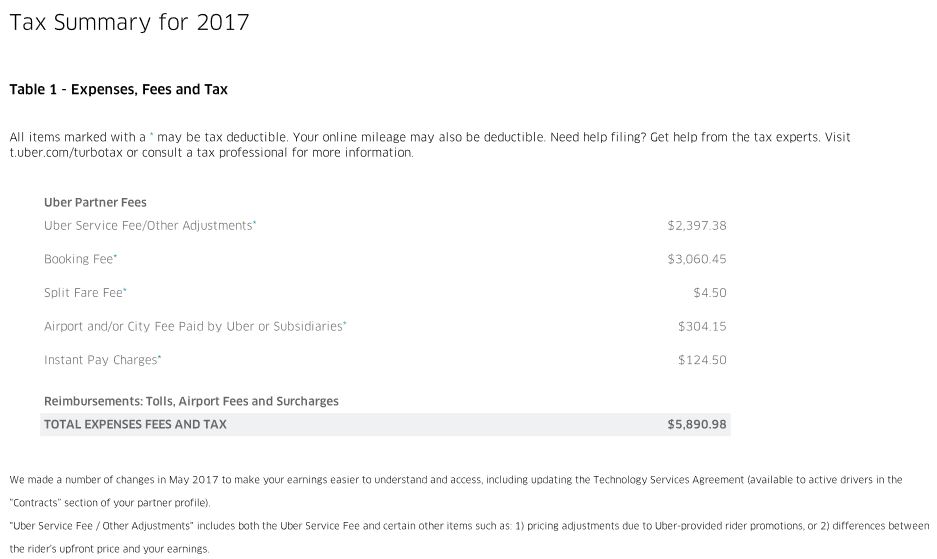

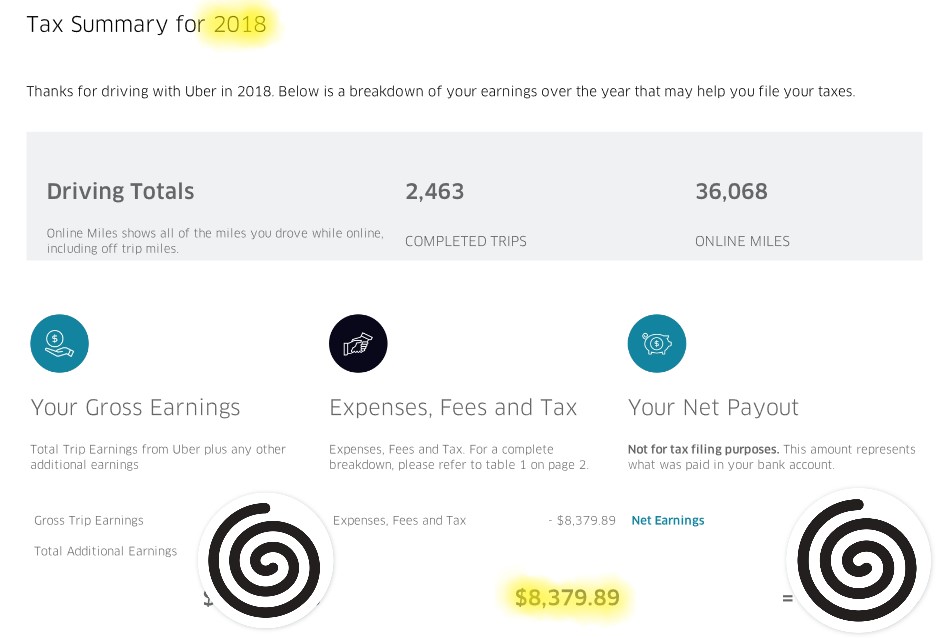

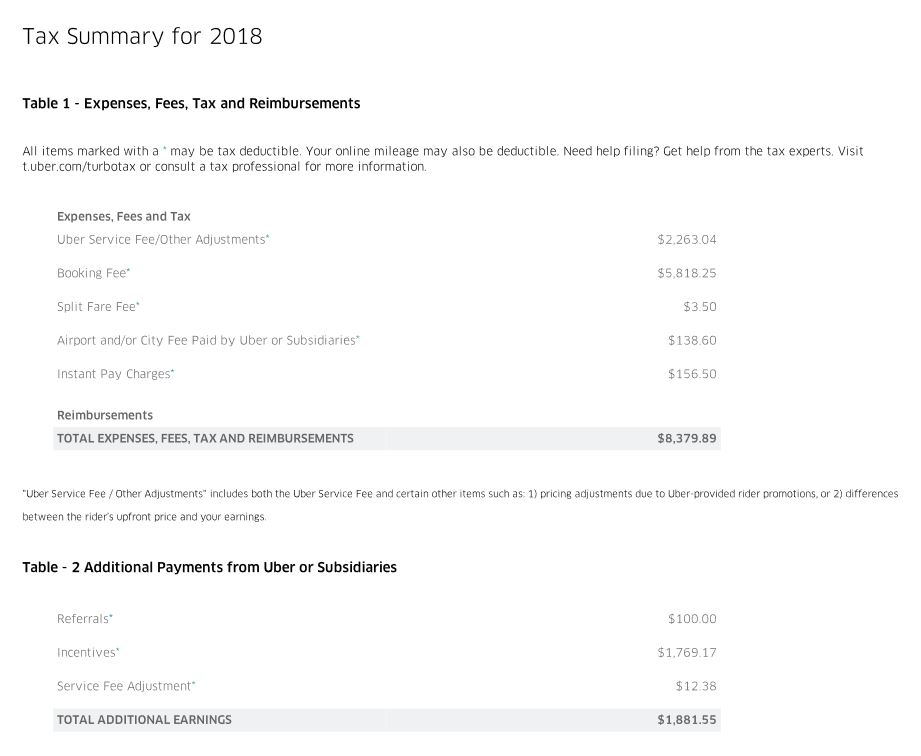

Here are screenshots of what Uber provides for tax purposes:

If I divide that amount of $5,890.98 by 12 months, it means I’ve really paid an additional $490.91 a month to drive Uber!

Table 2 represents additional earnings added to my Gross Earnings.

So, dividing $8,379.89 by 12 months means I paid an additional $698.32/month to drive Uber!

That is INSANE! And I didn’t realize until recently.

Oh, and Speaking of Money . . .

There’s Got To Be Something Better

Since discovering the HERide app servicing the metro Atlanta area, here’s what I’ve learned:

- Drivers earn 80% of rider fares and the minimum trip fare is $10.00;

- Direct deposit is weekly right now, but Instant Payouts will be available soon;

- Driver earnings are SO better than Uber and Lyft’s “take it or leave it”, non-adjustable upfront fares; and

- Riders are paying a lot less with HERide and are excited to tell others.

Get the HERide app and enter my name, Anita Johnson or

AN24E as the Invite/Referral code.

Thanks SO much for taking time to visit.

PLEASE freely share this information with your rideshare friends and family!

It’s that simple and would be so appreciated.

You have NO idea who YOU know that needs this information.

Remember: YOU Do NOT Need To Be a Rider or Driver to help support the movement for a BETTER rideshare experience. Just share this site with others!

P.S. I’m fairly certain you will find value in the content presented here because it doesn’t exist anywhere else. It is my personal experience as a rideshare driver in Atlanta since August 2016. This site was created during Easter 2017 and has found new life since finding HERide.

So, feel free to TIP your rideshare and HERide driver, Anita Johnson. Every moment not “driving for dollars” results in a lot of time to do any and everything, but no money is made immediately. Rideshare drivers are out here for the money. Why else would we drive people from Point A to Point B in the ATL? 🙂

Appreciate Your Support as We ALL Do Better in Rideshare!